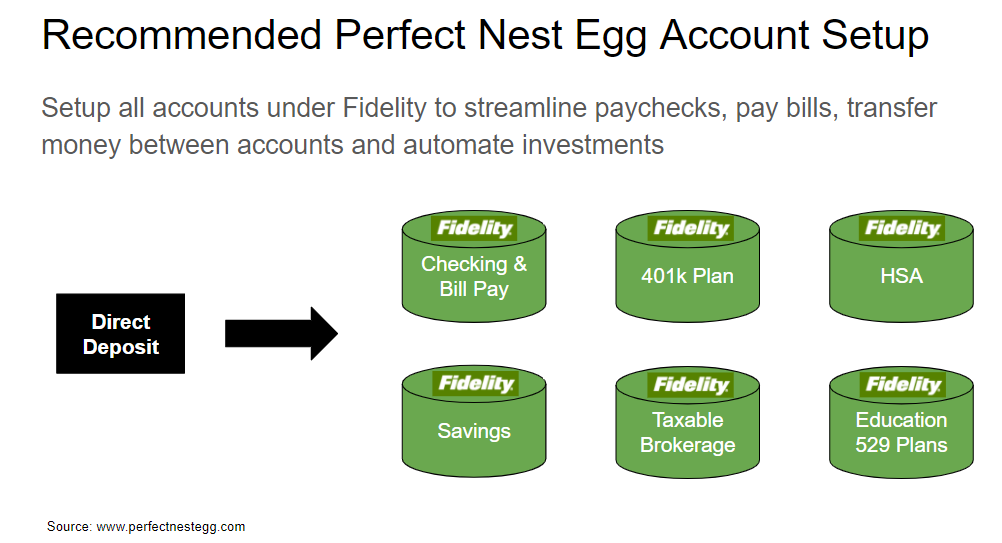

I consolidated all of my banking and investing with Fidelity to streamline depositing paychecks, paying bills, transferring money between accounts and investing. It saves me a ton of time moving money between checking to brokerage accounts to buy stocks, and I can pay my bills through Fidelity Bill Pay. Check out the diagram below for my recommended setup.

- Step 1 – Setup a new Fidelity checking account, direct deposit and bill pay. Follow the steps by clicking the link here: https://www.fidelity.com/spend-save/get-started

- Step 2 (optional) – Setup a Fidelity savings account (optional). For some folks, having a separate account helps to encourage saving for unexpected expenses. If this is your style, go ahead and setup a savings account Open account

- Step 3 – Setup a 401k account. My employer already uses Fidelity, so I didn’t need to setup a new account. If your employer doesn’t use Fidelity, you can setup a new account and easily rollover your 401k to the Fidelity

account tax free. Alternatively, setup a IRA. Open account

- Step 4 – Setup a Brokerage account, which allows you to purchase stocks, ETFs and other types of investments. Open account

- Step 5 – Setup a 529 Plan to save for your child’s future education expenses. Your investments grow tax free as long as the funds are used for qualified educational expenses. Check out Fidelity’s website for more

information. Open account

- Step 6 – Setup a Health Savings Account “HSA.” In my case, my employer uses Optum Bank, so I filled out a transfer form to move my HSA investments from Optum to Fidelity. Note – if you don’t already have a HSA account, check with your employer whether they offer it as there are certain qualifications that need to be met. Open account

Summary

The benefits of having all my accounts under Fidelity are huge. My paychecks automatically deposit to my cash account and I have automatic monthly transfers running between all of the above accounts seamlessly. Most importantly, I can view the activity of all my accounts by logging into one website.

Lastly, and most importantly, I’m setup for future retirement when I will need to draw down from retirement accounts. I highly recommended you take the time to consolidate your accounts – it’s worth the extra time spent upfront to spend less time maintaining your finances every month.